FOR ONLINE BUSINESS OWNERS LOOKING TO LOWER THEIR TAXES – LEGALLY

"New Playbook Reveals Little-Known Secret That Smart Online Business Owners Are Using To Pay 0% Taxes Without Stress And Complex Setups"

...All Without Confusing Jargon or Losing Sleep Over Complex Paperwork and Hidden Fees.

...All Without Confusing Jargon or Losing Sleep Over Complex Paperwork and Hidden Fees.

Here's the thing: It’s not your fault you're overwhelmed by taxes.

Hey there, fellow entrepreneur,

Remember when you first launched your online business?

The freedom, the excitement of finally being your own boss…

You probably thought, “This is going to be life-changing!”

Fast forward to now:

You’re drowning in tax bills and legal obligations, paying way more than you should.

Sound familiar? If you’re nodding (or pulling your hair out), you’re not alone.

The tax system isn’t trying to ruin your business. It’s just playing by rules you don’t fully understand—yet

...but what if you could?

Your All-in-One Guide to Legally Pay 0% Taxes and Grow Your Business Stress-Free 📚💼

But before we dive in, let’s address the massive elephant in the room...

Hiring expensive accountants 💸

Setting up a complicated business structure in your home country 🏛️

Even moving money around in ways that make your head spin 🌀

If you’re like most online entrepreneurs, you probably ended up with:

1. An accountant who charges a fortune but still doesn’t lower your taxes 💰

2. A business structure that’s so confusing you don’t even know where to start anymore 🤯

3. Tax bills that seem to grow every year, no matter what you do 📈

And let’s not forget the “expert” solutions:

That high-priced tax advisor who suggested opening an office in a tax haven for an outrageous fee ✈️

The complex tax schemes that only brought you more paperwork—and more headaches 😖

The offshore account setup that cost more than your first year’s revenue and left you questioning if it was even worth it 🚗💨

The tax system isn’t trying to ruin your business. It’s just playing by rules you don’t fully understand—yet

...but what if you could?

I get it. You’re skeptical.

Others were thinking:

Trust me, I've been there.

Wondering if I’d ever be able to grow my business without the taxman taking a huge cut of my hard-earned money.

🌟 The Game-Changer: A Simple U.S. LLC

Access U.S. Market

The US is the world's largest economy. Get instant credibility and access to new markets and partners.

INCLUDED

Protect Your Privacy

In states like Delaware or Wyoming, your identity as the owner remains confidential, ensuring you can operate discreetly.

INCLUDED

Secure Your Assets

Your personal belongings will be protected from business liabilities, keeping your wealth safe.

INCLUDED

Pay 0% Taxes

With no U.S. federal taxes, your profits will stay untaxed and your company will totally exempt from paying taxes.

INCLUDED

Maximum Flexibility

No need for complex accounting. You'll operate your LLC however you want, with total control over decisions.

INCLUDED

No Double Taxation

If you're in a tax-heavy country, you’re only taxed once at the individual level, maximizing your earnings.

INCLUDED

Get Global Investors

The LLC structure is trusted worldwide, making it easier to secure investments from U.S. and international sources.

INCLUDED

U.S. Bank Accounts

Easily open U.S. bank accounts and gain access to American financial institutions and improving business credibility.

INCLUDED

Low Setup Costs

Set up and maintain your LLC affordably, especially in states like Wyoming or New Mexico, where fees are minimal.

INCLUDED

No U.S. Residency Needed

Run your tax-free U.S. LLC from anywhere in the world, without the need for physical presence or U.S. citizenship.

INCLUDED

The United States of America is the No. 1 tax haven in the world.

U.S. law offers total tax exemption to all those people who are not residents or citizens of the United States, just by opening an LLC.

This isn’t about finding another complicated tax loophole.

It’s about using a simple, proven legal framework that allows you to take full advantage of the U.S. tax system – completely stress-free.

In The LLC Playbook, you’ll discover:

The “U.S. Tax Code Decoder” – Uncover how to legally reduce your tax liability to 0% by understanding key LLC benefits and regulations.

The “State of Incorporation Strategy” – Learn which U.S. states offer the most tax-friendly options and how to choose the right one for your LLC.

The “No More Audits” Blueprint – Master the steps to ensure your LLC is fully compliant, so you can avoid red flags and sleep soundly.

The “Expense Optimization Method” – Maximize your deductions and keep more of your income without needing a complicated offshore structure.

The 5-minute “Setup System” – A simple, step-by-step guide to get your U.S. LLC up and running quickly, with minimal hassle.

The “International Tax Advantage” Approach – Learn how a U.S. LLC can help you avoid paying taxes in both your home country and the U.S.

The “Revenue Protector” Guide – Discover how to shield your profits from unnecessary taxes and reinvest them into scaling your business.

Stress-free Filing Techniques – Get rid of tax headaches with easy compliance strategies that simplify your annual filing requirements.

The “Legal Peace of Mind” Toolkit – Learn how to structure your LLC for ultimate protection against legal risks and unexpected claims.

The “Zero-Tax Playbook” – Master the exact process for setting up a U.S. LLC that allows you to legally pay 0% taxes, while still scaling your business globally.

Check out our success stories:

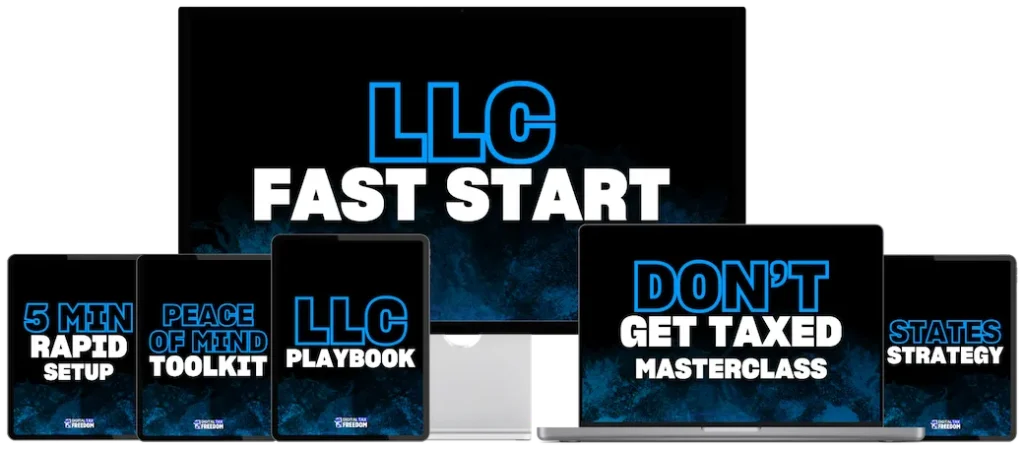

Here's everything You’re Getting

For Just $397.00

$47.00 Today

The LLC Playbook

(Digital PDF Download)

LLC Fast Start

(Video Training)

Don't Get Taxed Masterclass

(Spreadsheet)

5 Min Rapid Setup

(Digital PDF Download)

Peace of Mind Toolkit

(Video Training)

States Strategy

(Spreadsheet)

That’s less of one sleepless night of lost productivity. 💸

Still not convinced?

Here’s our iron-clad guarantee: ⚠️

We’re so confident that The LLC Playbook will help you legally reduce your tax bill to 0% that we offer a 14-day money-back guarantee.

If you don’t start seeing real savings on your taxes within 14 days of implementing our step-by-step strategies, just send us an email, and we’ll refund your $47 investment—no complicated questions, no hoops to jump through.

And don’t worry, it’s not like we can take back what you’ve already learned, right? You’ll still have access to all the tax-saving insights and bonus materials worth over $390.

Use them to scale your business, protect your revenue, and keep more of your hard-earned money in your pocket!

But fair warning: This offer won’t last forever.

Just like those tax-saving strategies that seem too good to be true and then vanish, this deal could disappear at any moment. ⏳

Click the “Get Instant Access” button now. Your business, your profits, and your peace of mind will thank you. 👇

P.S. Still on the fence?

Remember, you’re just one click away from discovering how to legally reduce your tax bill to 0%

…and finally escape the never-ending stress of overpaying on taxes.

Don’t let another year of unnecessary tax payments drain your business. 💼💸

Here's Everything You’re Getting For $397.00

Just $47.00 Today

LLC No-Tax Strategy

$47.00 Today

Check out these success stories:

Frequently Asked Questions

Creating an American LLC is the perfect solution for all those people who have an online business, are freelancing remotely, or are building a digital business as an agency, ecommerce, self publishing, dropshipping, or generally selling services.

This is because, if you are not a U.S. resident, U.S. law allows you to create a business that pays no taxes.

Yes. Having a U.S. LLC is completely legal no matter what country you are a resident or citizen of. All states allow their citizens to open companies in foreign states wherever they prefer.

To qualify for an LLC that pays 0% tax, you do NOT have to be a U.S. citizen or resident.

Using an American LLC to grow your business has several advantages, especially for those with a digital business:

– Zero taxes: the U.S. LLC, if created by a person who is not a U.S. resident, pays no taxes whatsoever.

– Total privacy and anonymity: this type of business does not publicly reveal the name of the owner. This means that no one can ever know that the business belongs to you. In addition, the U.S. legal system makes it extremely difficult and expensive to prosecute an LLC.

– Extreme ease of management: the LLC does not require you to create and manage invoices. It is not required to keep accounts and has no special bureaucratic obligations, like the usual European companies.

– Total protection of your assets: an LLC, from a legal point of view is exactly like a limited liability company. This means that in case of legal disputes, your personal assets as owner or your assets, cannot be attacked.

– U.S. and global market access: an LLC is an entity that provides access to all central platforms of global digital commerce. Therefore it is a recommended solution for those who want to sell online, or offer services worldwide, and want to use the best platforms to do so.

Yes, you can sell to U.S. companies and customers through your U.S. LLC. Many of our clients use their LLCs to do business with American companies, sell to U.S. customers via platforms like Shopify and Amazon, and receive payments through Stripe, Upwork, Fiverr, and similar services.

With a U.S. LLC you can get paid by other U.S. companies and customers without any issues, and remain tax free.

No, this tax-free opportunity is only for Non-US residents.

Privacy Policy Terms & Conditions

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

The information provided in this product is intended for general informational purposes only and does not constitute professional advice of any kind, including but not limited to legal, tax, financial, or business advice. The strategies and concepts discussed in this book are presented as educational material and are not meant to substitute for the advice of qualified professionals.

The author and publisher of this product make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of the information contained herein for any specific purpose. The use of this product does not create an attorney-client, accountant-client, or other advisory relationship between the reader and the author or publisher.

Before taking any actions based on the information in this product, it is strongly recommended that you consult with a licensed attorney, tax advisor, accountant, or other qualified professionals who can provide advice tailored to your specific situation. The author and publisher disclaim any and all liability to any individual or entity for any loss or damages, whether direct, indirect, incidental, consequential, or otherwise, that may result from the use or misuse of the information contained in this product and course.

By reading this product, you acknowledge that you are solely responsible for any decisions you make and the actions you take. The author and publisher expressly disclaim any and all responsibility for any consequences that may arise from the use of the information provided herein.

This product is brought to you and copyrighted by ZeroTax Strategies.